Struggling to qualify for a mortgage? Non-QM loans can help you overcome obstacles, making your dream home in San Diego more attainable than ever.

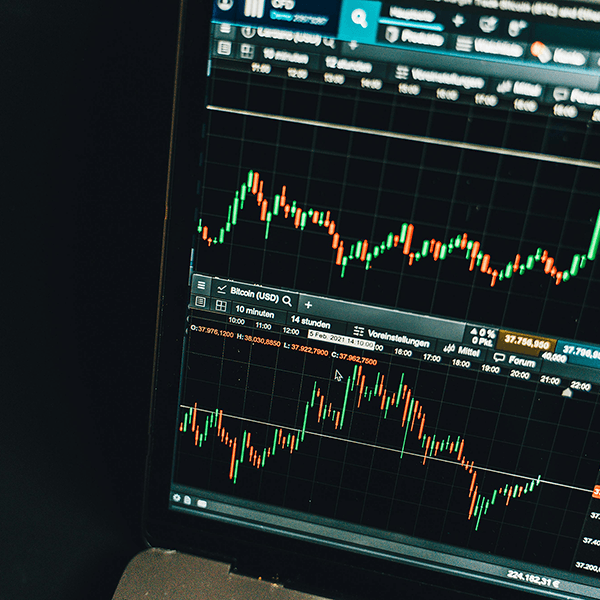

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Ready to conquer the L.A. housing market? FHA loans make it simple, giving you the boost you need to turn your dream home into a reality—no more waiting!

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Are you unsure which loan option is right for you? Discover how to navigate the choice between VA and conventional loans to secure your dream home seamlessly.

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Ready to ride the housing wave? Discover tips to spot great deals in Newport Beach that keep you afloat, even in a changing market. Your dream home awaits!

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.